This was according to the recent Indonesia Halal Markets Report 2021/2022 that was jointly published by Bank Indonesia, Indonesia Halal Lifestyle Center, and DinarStandard.

With consumer spending of $184bn in 2020, Indonesia represents the largest halal consumer market in the world, accounting for 11.34% of global halal economy spend.

However, Indonesia is only the ninth-largest export of halal products to the Organisation of Islamic Cooperation Countries (OIC), exporting $8.6bn in halal products. This accounts for 3% of halal exports.

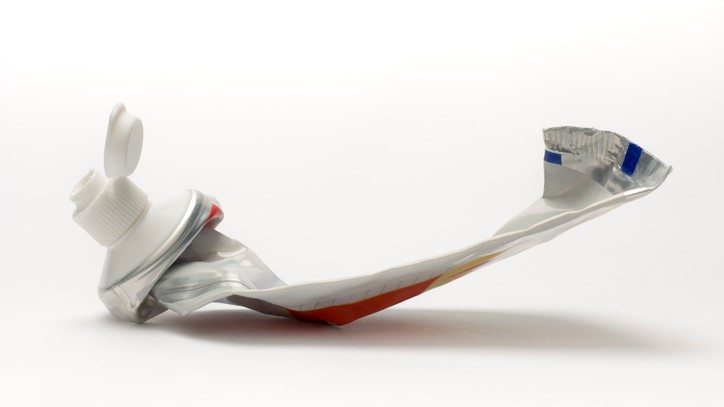

To boost its exports, the report underscored categories with high export potential, including a $20m opportunity in oral care.

Halal oral care manufacturers can capitalise on the increasing concern for health among consumers, especially following the COVID-19 outbreak.

This has resulted in an ever-increasing demand for cruelty-free, organic, natural, and vegan-certified products.

The report noted that this could enhance the demand and global appeal for halal-certified products, as it has shared traits and principles with many of these values.

CosmeticsDesign-Asia has previously reported that the oral care segment was in the midst of a transformation from a basic health care product to a beauty and lifestyle essential, with brands such as Australia’s Lovebyt and India’s Vedix disrupting the market.

Top markets to tap

Potentially, United Arab Emirates, Saudi Arabia, and Malaysia represented the biggest opportunities among the OIC that Indonesian oral care manufacturers can tap into.

Meanwhile, the top three opportunities outside the OIC were Germany, UK and US.

At the moment, Indonesia is the 16th largest exporter of oral care to the OIC behind top exporters China, Egypt and Thailand. China accounts for the largest share which represents of 25.7% of market share.

Growing its oral care exports could help the country boost its cosmetics exports.

According to the report, Indonesia is the fourth-largest importer of cosmetics in the OIC, however, only ranks 20th in exports globally.

Globally, global Muslim consumer spending on cosmetics is expected to rise to $93bn in 2025 from $65bn in 2020.

The COVID-19 pandemic led to the first negative growth in GDP that Indonesia has experienced since 1998 and has emphasised the importance of the development of its halal industry as a source of growth.

The report also highlighted the shortcomings Indonesia would have to overcome to tap into its opportunities in the global halal market.

It underlined that ‘closer cooperation’ was needed between halal certification institutions, producers, scholars, researchers, and the government to create regulations that would bolster Indonesia’s position as a leader in the halal economy

Furthermore, the report stated that there were a limited number of players in Indonesia that could hold their own on a global stage, as there was a notable gap in the R&D and the manufacturing of halal-suitable ingredients.