Halal beauty brands are gaining popularity among young consumers in Asia, especially in predominantly Muslim countries such as Indonesia and Malaysia. Halal-certified cosmetics companies such as Indonesia-based Rose All Day Cosmetics (RADC) registered four times annual revenue growth in 2022, signifying the growing demand for halal cosmetics space in the region.

The Muslim community accounts for 28% of the Asian population. To comply with their religious observations, halal claims are crucial for cosmetics companies to succeed in the region and in Muslim-majority countries such as Indonesia, halal certification for cosmetics will be mandatory by 2026.

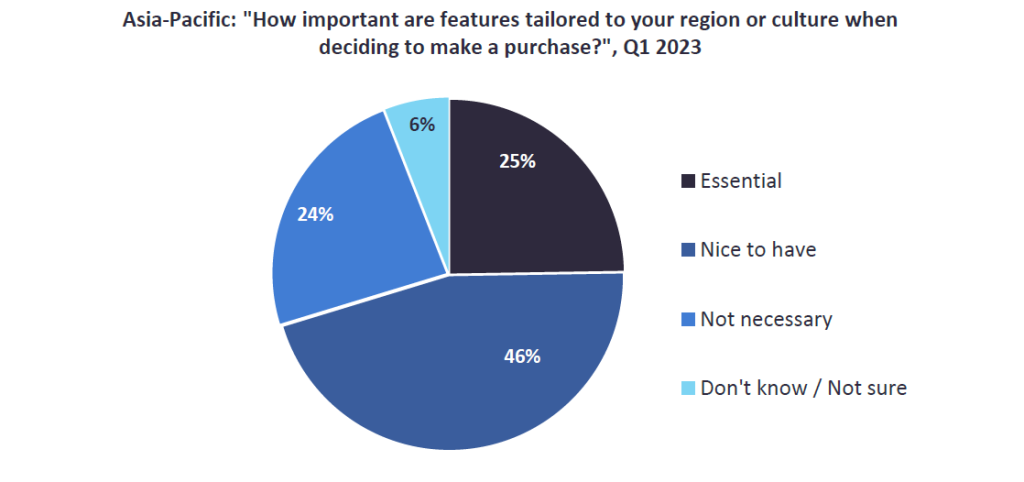

According to GlobalData’s 2023 consumer survey, 25% of Asia-Pacific respondents feel that a product tailored to their region or culture is essential while making a purchase. 25% of survey respondents said that they pay a very high amount of attention to ingredients used in their beauty or grooming products.

Non-Muslim communities are also embracing halal cosmetics due to their perceived beauty and wellness attributes. Building awareness about the benefits of halal-certified beauty products is pivotal for gaining traction among the non-Muslim population.

Homegrown halal cosmetics brands are playing an instrumental role in generating demand for these products across Asia. Local halal cosmetics are highly preferred among the younger population in Asia due to these products’ compatibility with diverse Asian skin tones, and affordable pricing is further stimulating demand.

Local brands have also been developing cosmetics suitable for local weather conditions. To leverage this trend, multinational companies are now investing in local brands. In one example, Unilever invested $6 million in Esqa, an Indonesian beauty brand.

Developing cosmetics without key ingredients is a challenge for beauty and grooming product formulators. For instance, alcohol, which is used to make face creams less greasy and dry quickly, is forbidden under Islamic law. Packaging facilities also need to comply with halal regulations. Despite these challenges, considering the increasing Asian consumer spending on natural cosmetics, the growth opportunities for halal-certified cosmetics in the region is promising.